In its May 11, 2016 decision in Eifert v. Eifert, the Appellate Division, Second Department, appears to discuss the interrelationship between the calculation of child support and the “income” shown on a partnership K-1 tax form. In truth, it does not.

In its May 11, 2016 decision in Eifert v. Eifert, the Appellate Division, Second Department, appears to discuss the interrelationship between the calculation of child support and the “income” shown on a partnership K-1 tax form. In truth, it does not.

In their divorce settlement agreement, the parties agreed that the father would pay child support consisting of two components. The first component required the father to pay $4,400 per month. As summarized by the Second Department in its opinion, the second component required the father to pay “25% of the income he derived from his ownership of stock in Eifert French & Co.”

Years later, the mother sought to recover child support arrears in the sum of $63,283.25 arising from the second component of the father’s child support obligation. The mother arrived at this sum by performing calculations based on K-1 statements received by the father from Eifert French & Co.

In opposition, the father contended that the second component of his child support obligation should be calculated based only on distribution checks he received from Eifert French & Co, rather than the income reflected on his K-1 statements. Based on that limitation, the father calculated that the correct amount of arrears he owed for this second component of his child support obligation was $21,137.49.

Supreme Court, Westchester County Justice Colleen D. Duffy agreed with the father and found arrears to be $21,137.49. The mother appealed.

The Second Department affirmed, holding that contrary to the mother’s contention, the record reflected that Justice Duffy properly found that the parties’ intent was to calculate the second component of the father’s child support obligation based on the distribution checks issued to him by Eifert French & Co.

The Court’s holding would appear at odds with the statutory definition of “income” used to calculate support under the Child Support Standards Act (C.S.S.A.). There, the statutory formula percentage is applied to parental income which is found by starting with the “gross (total) income as should have been reported in the most recent federal income tax return.” Family Court Act §413(1)(b)(5)(i); Domestic Relations Law §1-b(b)(5)(i).

Commonly, the owners of a small business entity style the entity as a partnership, S-corporation, or limited liability company. In that way, there is no taxation of business profits at the corporate or partnership level. Rather, the income generated by the entity is passed through to the owners and reported only on the owners’ personal tax returns. While using the pass-through structure saves on the total income tax bill, it can also cause confusion for the owners. The amount of profits claimed on an owner’s tax return may be very different than the money the owner actually receives as a share of the profits.

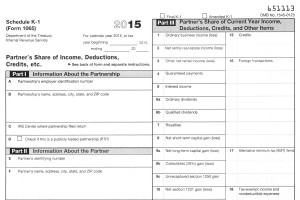

To reflect the taxable income generated by the entity, the entity provides a Schedule K-1 to each partner, shareholder or member. The K-1 lists a proportionate share of net income and write-offs for each individual owner. The partnership or S corporation files a tax return that shows the income or losses the company incurred for the year, but the company pays no taxes directly. Each owner must report on his individual return and pay taxes on any net income listed on the owner’s K-1 (see, the K-1 form; and its instructions).

Thus, for C.S.S.A. purposes, the income upon which child support is calculated is not limited to the actual distributions made by the business entity. Rather, parental income includes the parent’s share of all income of the entity, whether or not the income was distributed. Conversely, distributions to the owner-parent by the entity out of accumulated assets and not out of current income would not be taxed as income; would not be reported on the individual owner’s tax returns; and would not be included (at least at the outset) in the calculation of parental income.

In Eifert, however, the parties’ agreement did not state that the second child support component was, as summarized by the Second Department, “25% of the income he derived from his ownership of stock in Eifert French & Co.” Rather, according to counsel, the parties’ agreement provided that as the second component, “The Husband shall pay to the Wife as and for child support an amount equal to 25% of the annual distribution of profits received by the Husband from his interest in . . . .” Thus, it appears the court correctly applied the parties’ agreement, and did not interpret the term “income.”

Kenneth Novenstern and Lisa Solomon, of Novenstern Fabriani & Gaudio, LLP, of Mt. Kisco, represented the mother. Jerry F. Kebrdle II, of White Plains, represented the father.