In its May 11, 2016 decision in Eifert v. Eifert, the Appellate Division, Second Department, appears to discuss the interrelationship between the calculation of child support and the “income” shown on a partnership K-1 tax form. In truth, it does not.

In its May 11, 2016 decision in Eifert v. Eifert, the Appellate Division, Second Department, appears to discuss the interrelationship between the calculation of child support and the “income” shown on a partnership K-1 tax form. In truth, it does not.

In their divorce settlement agreement, the parties agreed that the father would pay child support consisting of two components. The first component required the father to pay $4,400 per month. As summarized by the Second Department in its opinion, the second component required the father to pay “25% of the income he derived from his ownership of stock in Eifert French & Co.”

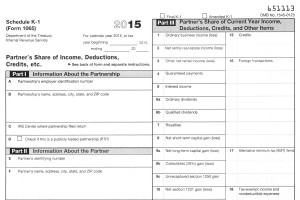

Years later, the mother sought to recover child support arrears in the sum of $63,283.25 arising from the second component of the father’s child support obligation. The mother arrived at this sum by performing calculations based on K-1 statements received by the father from Eifert French & Co.

In opposition, the father contended that the second component of his child support obligation should be calculated based only on distribution checks he received from Eifert French & Co, rather than the income reflected on his K-1 statements. Based on that limitation, the father calculated that the correct amount of arrears he owed for this second component of his child support obligation was $21,137.49.

Supreme Court, Westchester County Justice Colleen D. Duffy agreed with the father and found arrears to be $21,137.49. The mother appealed.Continue Reading K-1 Income and the Calculation of Child Support