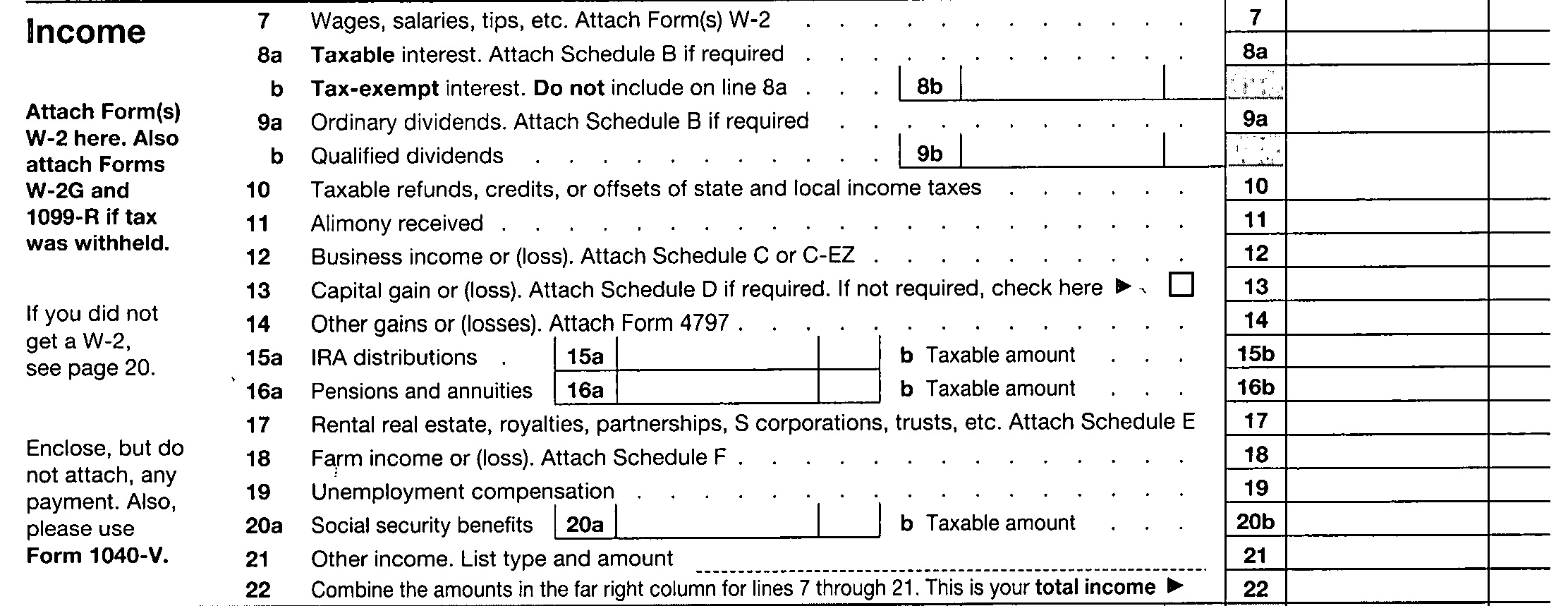

Have you looked at an IRS Form 1040 (pdf) lately?

Looking at the 1040 is supposed to begin the C.S.S.A. calculation for determining child support. For actions commenced on or after October 13, 2010, it is also the first step when determining temporary maintenance. When computing child support under either the Family Court Act or the Domestic Relations Law, the calculation starts with a determination of parental income. F.C.A. §413(c)(1) or D.R.L. §240(1-b)(c)(1). Determining parental income under either F.C.A. §413(b)(5)(i) or D.R.L. §240(1-b)(b)(5)(i) begins by looking at the:

gross (total) income as should have been or should be reported in the most recent federal income tax return.

The recent amendment to D.R.L. §237(B) adopts the C.S.S.A. definition to begin the calculation of a temporary support award under D.R.L. §237(B)(5-a)(b)(4):

“Income” shall mean:

(a) income as defined in the child support standards act . . . .

There actually is a line on the federal income tax return which reports the “total income.” It’s line 22:

Although “gross” income is a term in the statute, but not the 1040, its context is made clear when reference is made to the calculation of Adjusted Gross Income which begins on line 23.

In the March 18, 2011 decision of Supreme Court Justice Delores J. Thomas in J.H. v. W.H., the Court granted the wife temporary relief, including formulaic awards of maintenance and child support. The husband, a court officer, earned $107,953 in 2009; the wife, a part-time teacher, earned $11,660. Presumably, those numbers would be combined and shown on 1040 line 7.

The parties jointly own two pieces of realty. The wife and children live in one of them, in which there was another apartment yielding gross rental income of $1,500.00 per month. The monthly mortgage was $3,300.00 per month. The husband lived in the basement of the second parcel. In that property, there were two other apartments yielding $2,588.00 per month in gross rent. The mortgage cost $3,250.00 per month.

When applying the C.S.S.A. formula, Justice Thomas did not reflect the determined loss for either rental property. Rather, the Court held, “[b]ecause the rental income does not cover the total cost of the parties’ investment, zero (0) was added to both incomes for this factor.” There is apparent support for not including gross rental receipts where a property is operated at a loss, but not recognizing net overall losses. Kristy Helen T. v. Richard F. G., 24 A.D.3d 788, 808 N.Y.S.2d 409 (2nd Dept. 2005); Knapp v. Levy, 245 A.D.2d 1027, 667 N.Y.S.2d 563 (4th Dept. 1997); Petkovsek v. Snyder, 255 A.D.2d 960, 680 N.Y.S.2d 336 (4th Dept. 1998). (note: [negative] cash flow does not equate to [loss] gain; certain payments are not deductible; certain deductions are available without cash payments)

However, line 17 of the 1040 would show net losses. They would be brought over from line 26 of Schedule E (pdf). Thus, the parties’ W-2 incomes should have been appropriately reduced when calculating “total income” on line 22 (note: the imported figure would already reflect the partial personal use to which each property was put).

While calculation of income is not limited to line 22 (Barber v. Barber, 240 A.D.2d 738, 658 N.Y.S.2d 738 [3rd Dept. 1997]), it is line 22, not line 7, which should be the starting point. Such is the express language of the statutes.

In J.H. v. W.H., Justice Thomas made the temporary maintenance calculations based only on the W-2 income parties, net of C.S.S.A. deductions for Social Security, Medicare and N.Y.C. taxes. Doing so, Justice Thomas arrived at the “guideline amount” of $26,708.26 in annual temporary maintenance.

Then, Justice Thomas went right to calculating C.S.S.A. formula child support, now deducting from the husband’s income the guideline maintenance award. With 3 children, the base support obligation was 29% of the husband’s adjusted income of $69,845.29, or $20,255.13. The Court noted that when computing the wife’s portion of combined parental income for pro rata add-on allocation, the Court would disregard the wife’s receipt of the $26,708.26 maintenance award (note: see discussion in April 5 blog).

The Court found that the 26,708.26 in annual temporary maintenance was not unjust or inappropriate, and added to that award the $20,255.13 in child support. The Court also stated that each party would receive the rental income of the property in which he/she resided, and use such to pay that property’s mortgage.

Reality check: As a result, from his $107,953.00 in gross earnings, the husband will be left with $49,590.16 after the deduction of Social Security, Medicare and New York City taxes and the maintenance and child support awards. From that, he must (?) pay the $4,472.00 to $7,944.00 shortfall in the mortgage on his residence (net: 41,646.16 to $45,118.16), income taxes, 86.09% of medical add-ons, and personal expenses.

The wife will have her income after C.S.S.A. deductions of $11,289.46, plus the $46,963.39 in awards, for a total of $58,252.85. From this she must (?) pay the $22,152 shortfall in the mortgage on her residence (leaving $36,100.85), income taxes, 13.91% of medical add-ons, and the personal expenses of herself and the children.

It is only in this final light that on a temporary basis, the awards may make sense (a more precise look at income taxes payable [and other required expenses] would be necessary, but admittedly, rarely, if ever, available). Perhaps, that bottom line is the most important thing.

However, the ends (even temporary) do not, in a judicial system, justify the means. If judges will be using a formulaic approach to temporary awards (or permanent awards, for that matter), ignoring the plain language of the C.S.S.A., and disregarding the bona fide business and investment losses which are reflected in “total income” under the tax law, invites unfairness, ridicule, unworkability, and increased domestic tensions.