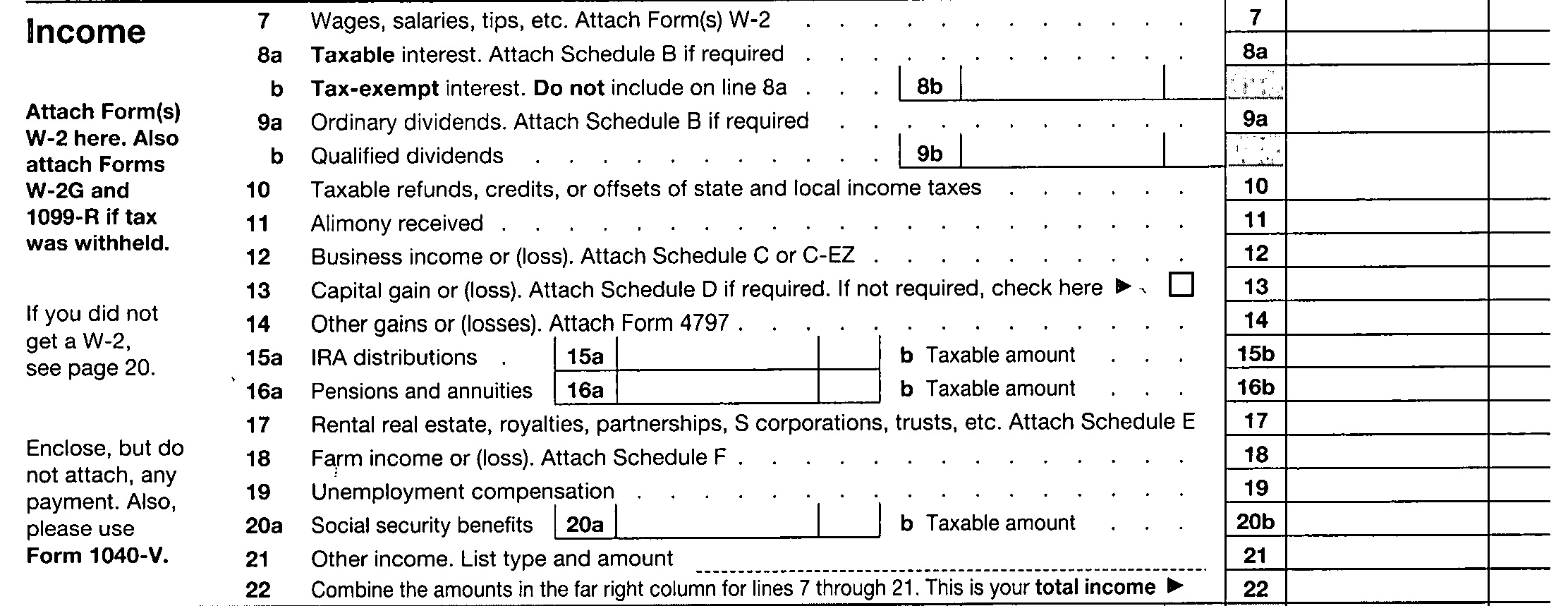

Have you looked at an IRS Form 1040 (pdf) lately?

Looking at the 1040 is supposed to begin the C.S.S.A. calculation for determining child support. For actions commenced on or after October 13, 2010, it is also the first step when determining temporary maintenance. When computing child support under either the Family Court Act or the Domestic Relations Law, the calculation starts with a determination of parental income. F.C.A. §413(c)(1) or D.R.L. §240(1-b)(c)(1). Determining parental income under either F.C.A. §413(b)(5)(i) or D.R.L. §240(1-b)(b)(5)(i) begins by looking at the:

gross (total) income as should have been or should be reported in the most recent federal income tax return.

The recent amendment to D.R.L. §237(B) adopts the C.S.S.A. definition to begin the calculation of a temporary support award under D.R.L. §237(B)(5-a)(b)(4):

“Income” shall mean:

(a) income as defined in the child support standards act . . . .

There actually is a line on the federal income tax return which reports the “total income.” It’s line 22:

Although “gross” income is a term in the statute, but not the 1040, its context is made clear when reference is made to the calculation of Adjusted Gross Income which begins on line 23.Continue Reading "Gross (Total) Income" for the Purposes of Child Support and Temporary Maintenance

In this second of two blogs discussing Supreme Court Nassau County Justice

In this second of two blogs discussing Supreme Court Nassau County Justice

In its February decision in

In its February decision in